Hotline:

(+84) 898 898 688$611 billion will flow into real estate in Asia-Pacific

Cushman & Wakefield’s The Atlas Summary 2017 reports that investments in the Asia Pacific real estate market are expected to exceed $ 611 billion by 2017.

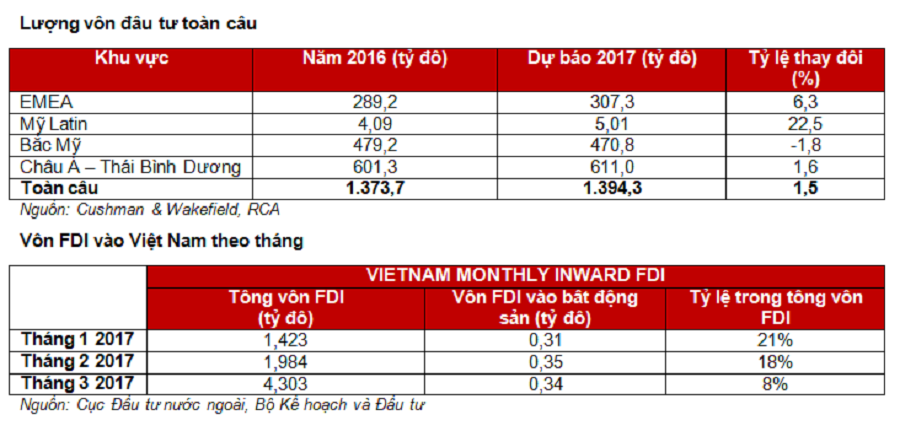

The figure is only 1.6% higher than in 2016 ($ 601 billion), but it still accounts for 44% of the world’s total investment in real estate ($ 1.39 trillion). Meanwhile, capital inflows into North America accounted for about 34% and Europe – Middle East – Africa (EMEA) accounted for 22% of total global investment.

Real estate investment flows in Asia Pacific accounted for 44% of total global investment

According to Sigrid Zialcita, Cushman & Wakefield’s Director-General for Asia-Pacific Studies: “Transactions in the office and land segment have ended the prospect of investing in Asia-Pacific. Binh Duong last year, with remarkable deals suggesting that investors remain focused on core markets, continue to invest heavily in assets and investment opportunities in construction projects. “.

Global investment by region

In 2016, developers paid the most money in the Singapore and Tokyo markets, while Chinese developers continued to push up investment in assets in major cities of China and Hong Kong. . Chinese investors are well aware of the opportunities in and outside the country, accounting for more than 50% of land transactions since 2016.

“Positive investment trends in the Asia-Pacific region are expected to continue in 2017, with good economic performance that will further bolster investor sentiment and increased demand for investment in modern commercial assets of domestic, regional and global investors.

However, given the uncertain economic outlook, global diversification of the property portfolio will continue to be a key strategy for some investors, leading to an increase in investing in new markets, “Ms. Sigrid added.

In the year 2017, the segment of office rental in key markets such as Sydney, Melbourne and Tokyo are still popular.

Core investment strategies (low risk risk management models, 7-12% profit) and “core plus” (risk management model from low to just right, 8-12% profit) will continue to target the Japanese and Australian markets. Due to limited supply in these markets, investors are likely to shift to other key markets such as China, Singapore and South Korea, as well as more risky markets in the smaller cities of the above.

Active investment trends in the Asia-Pacific region are expected to continue this year

Outsourcing trends will continue to bolster demand for large technology firms, while a general spatial outlook has led to increased demand for open-market urban areas. Some investment opportunities in emerging markets will be found in Asia, especially if economic conditions continue to stabilize and improve. In general, the Asia-Pacific region is tasting Stronger than before with the general recovery of the economy.

However, operational models will continue to be polarized due to macroeconomic risks. The change and polarization of the nature of the monetary cycle and the quantitative easing policy will increase uncertainty. Investors need to focus on the basic conditions as well as what makes a city and a property work for tenants there. Thus, the current pressures on the market not only come from growth: it is also the pressure to increase prices or seek opportunities in new lands.

“The changing monetary cycle is an additional motive that can define the investment landscape in this region.” The weight of core assets that attract capital will not fall and investors will have to Expanding the direction and diversification of investment strategies take into account opportunities that may reflect trends in demographics, technology, mobility, and urban regeneration. Core assets and future investments will be credited as the Asia-Pacific region begins a new phase of the investment cycle, “said Zialcita.

Ben Gray, director of capital markets for Cushman & Wakefield Vietnam, said: In 2016, the Vietnamese market has recorded the record of the amount of capital poured into the real estate market by investors. Put a lot of expectations into the profitability of this segment. That profit is driven by existing assets originating in emerging markets with the strongest macroeconomic fundamentals in the region.

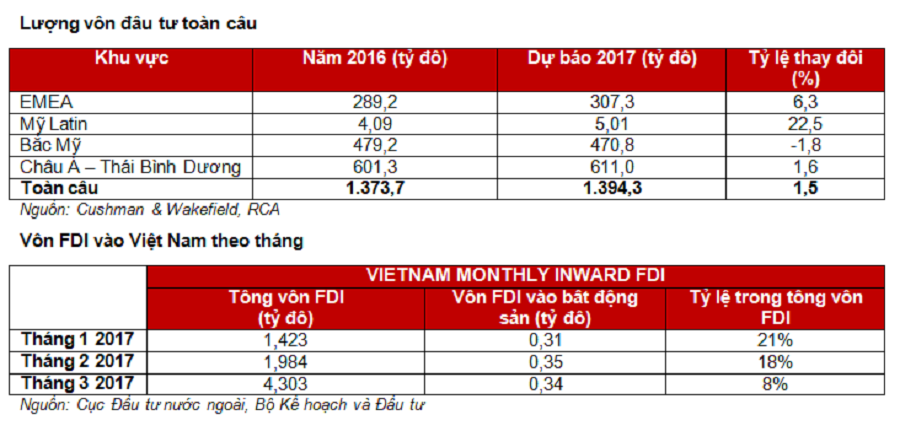

“We expect Vietnam will continue to attract investment capital in 2017, in particular, the amount of FDI committed and implemented in the first quarter 2017 has increased by 27% compared to 2016, reaching 3.4 billion “Investors’ confidence in the Vietnamese market is rising, and the market is considered one of the most attractive destinations for investment flows,” he said.

You are reading the article $611 billion will flow into real estate in Asia-Pacific in the Real Estate category at https://realestatevietnam.com.vn/.Any information sharing, feedback please email to contact.vietnamrealestate@gmail.com, Hotline (+84) 898 898 688 (24/7).

Special thanks!