Hotline:

(+84) 898 898 688Real Estate Investment Experience With Little Capital

When thinking about investing in real estate, many people often have to have a lot of capital to jump into this business channel. However, if you know how to calculate and choose carefully, those with less capital can still make a fortune from investing in real estate.

With Vietnam real estate, two of the easiest ways to make real estate investments are for those with small capital or those who jump into real estate investing.

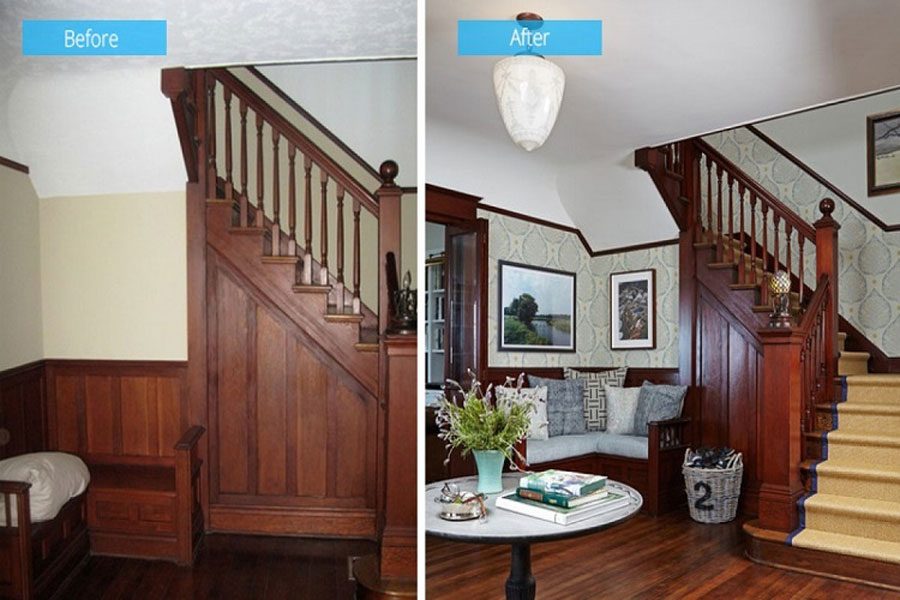

Mode 1: Renting the house and then renting out

This is one of the forms of real estate investment that many are “new” or less applicable. Most of them have a desire to raise capital slowly, relatively safely and with minimal risk. In this form, you will first need to spend some initial capital, usually not much, the range of 100 million redeemed. Then you will find a suitable home for rent, refurbished, cleaned up and then separated rooms for rent. Make sure your total monthly rent is more than the amount you pay to rent this house. If there is no trouble, with this form, only about 2-3 months that you were able to remove the capital.

Renting a house then renting out is one of the ways to invest in people with less capital

Experience to succeed in renting and leasing:

- The first is to choose simple, less complex structures that are easy to modify and separate rooms.

- Second only selects the properties the landlord accepts for the lessee’s right to renovate the home, and the landlord agrees to let the first tenant be allowed to use it for his or her sublet to avoid disputes later.

- Third, you should only choose houses in potential areas such as industrial parks, schools or high demand.

- Fourth, when the new lease, should add a bit of capital to repair, paint, refurbished rooms for new beautiful will be easier to rent for a better price.

- Fifth, consider carefully the issues related to electricity, water, internet lines … so that the most convenient inspection and management later, avoid losses.

- Sixth, there should be the selection of tenants from the beginning to avoid the arising, trouble later.

Possible risks of renting and leasing:

Although it is considered as a safe investment, less risk, there are still problems that investors need to know to prevent such as:

- There are few or no tenants: There are cases where after renting and refurbishing, the investor encounters the case that there are no tenants or the rent is too small to make up for the money. rent the whole house monthly. To minimize this problem, from the beginning need to carefully select the house and consider and calculate the rent accordingly.

- Issues related to room management: As renters flush money, electricity problems, facilities, … very often when renting rooms.

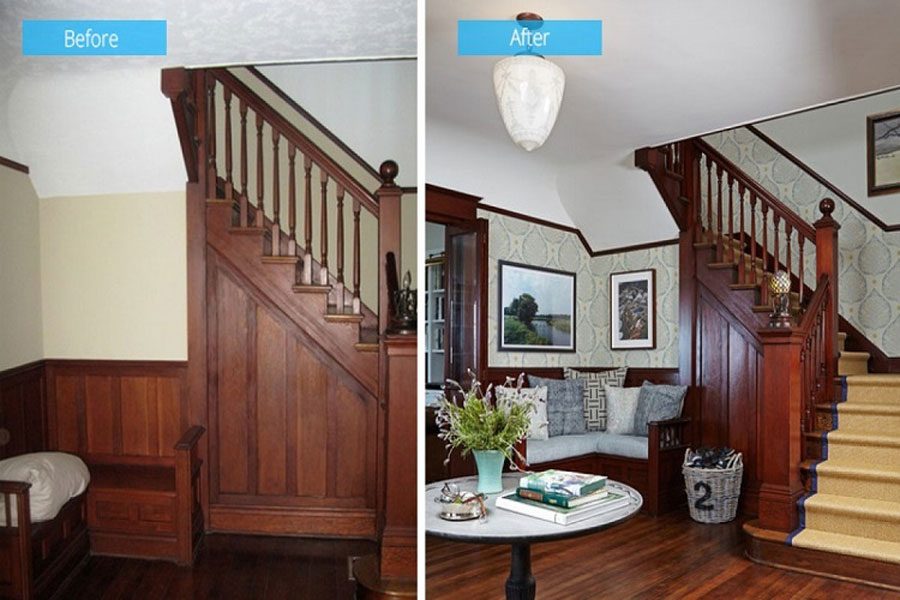

Mode 2: Buying second-hand houses, refurbishing and selling

The second form has the advantage of withdrawing capital, earning quite quickly compared to form 1. However, the risk is also higher and investors also need a little more capital. By buying grade 4 houses, decaying, then leaving some money to paint and refurbish, then the house can be offered for sale at a price higher than the original amount from a few dozen. million to 100, 200 million. Refer to the Experience of Buying Older Homes from the Real Estate.

Another lucrative investment is that you can buy old and refurbished houses to eat the difference

Successful experience with old home buying and refurbishing and selling:

- Firstly, it is necessary to have knowledge and knowledge about the real estate market in order to choose the most potential and most easily sold houses.

- Second, decay is usually cheap, but if in a good location, the price is sometimes very expensive. Therefore, investors need to consider the amount of money they have to spend to buy as well as to rearrange the house later and must be able to then how much they can sell than the amount of money spent. head.

- Third, consider and balance the costs of repairing your home. The money should not be too big because you repair the house better to sell the better price, not to stay.

Risks can be encountered in the form of buying used and refurbished homes and selling them:

- Resale prices are not expected compared to after being refurbished.

- Buy the wrong housing in the planning area.

- Do not sell or liquidate quickly and buried capital.

SUMMARY: Any form of investment implies a lot of risks. Therefore, investors should have the understanding and consideration before doing as well as responsible for the money spent.

You are reading the article “Real Estate Investment Experience With Little Capital” in the section “Real Estate News” on the website: https://realestatevietnam.com.vn/.

All information sharing, feedback please email to contact.vietnamrealestate@gmail.com, Hotline (+84) 898 898 688 (24/7).

Thank you for visiting our website!