Hotline:

(+84) 898 898 688Section 4( Part 1): Determining the real estate market

The successful real estate investment depends on market demand. At the time of investment, is the market going up or down, or is it on whose side? It is something that investors must determine before investing.

In Session 3 of the Specialized Investing View on Real Estate Investors, investors have identified eight types of real estate investment. This is the premise for investors to choose which products should invest.

But successful real estate investments depend on market demand. At that point, the market is going up or down? Who is the market? And how should investors control the expectations? In Section 4 (Part 1): To identify the real estate market, experts will provide suggestions to answer these questions.

Evaluate market movement

As mentioned in Session 3: Types of investment, real estate investment popular now includes 8 types. To choose one or more types of investments at any given time depends on how investors determine the up-and-down movement of those types of investments.

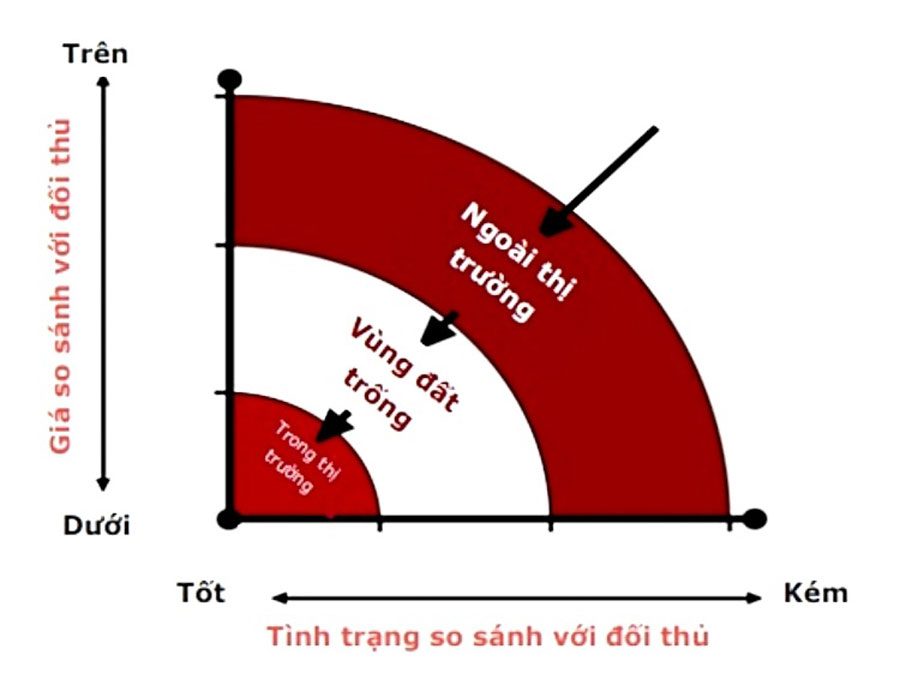

Specifically, experts put forward two market principles and values to determine the market operating. Market forces operate according to supply-demand rules. High supply and low demand lead to lower prices. Conversely, when supplies are low and demand is high, prices will increase.

The ability to sell is high when it is priced right and the house is in good condition.

Value determination is based on an agreement between a willing seller and a willing buyer. Tug games take place between the wishes of the seller and the amount the buyer is willing to pay.

In order to make a clear market assessment, investors need to continually learn about market conditions in the region and specific populations. There are four issues that investors need to clarify:

- Real estate inventory: How much is sold and how much inventory is increasing or decreasing

- Days on the Market: How long does it take for houses to be sold to buyers?

- Price per square meter: A good price comparison indicator – when a group of real estate have the same quality and characteristics

- Changes in the local scene: Track changes in big employers, shopping malls, schools, community services, and local law affecting land and housing.

Potential projects when launch or open sale will create “waves” affect the real estate market. Investors who take this opportunity to invest, buy, transfer or lease are profitable.

Swan Bay is one of the projects that investors are interested in and pour capital because of the potential in location, transportation infrastructure as well as utility.

Swan Bay project of SwanCity is an example. Located on the Nhon Trach peninsula with convenient transportation, not too far from the center, Swan Bay has good price as well as transferable situation. The sale of phase 1 as well as the launch of 66 limited villas have received the attention of customers.

Empire City Thu Thiem is “hot” to this point, after three referrals to customers, the products are booked and traded immediately after the launch.

Recognizing the supply-demand of different types is also an important factor for investors to pour capital. The supply of shophouse apartments is still relatively small but the demand for this project is always high. Currently, the number of apartments fluttering on the market is relatively low compared to the same period in 2017, investors tend to buy stocks to launch at a later time.

It is a fact that, in order to make timely investment decisions, investors have had to have a process of understanding, assessing and evaluating the market in order to set the trend of the market. It is the trend to move up or down will help investors to catch the market, earn attractive profits.

How to catch the market head?

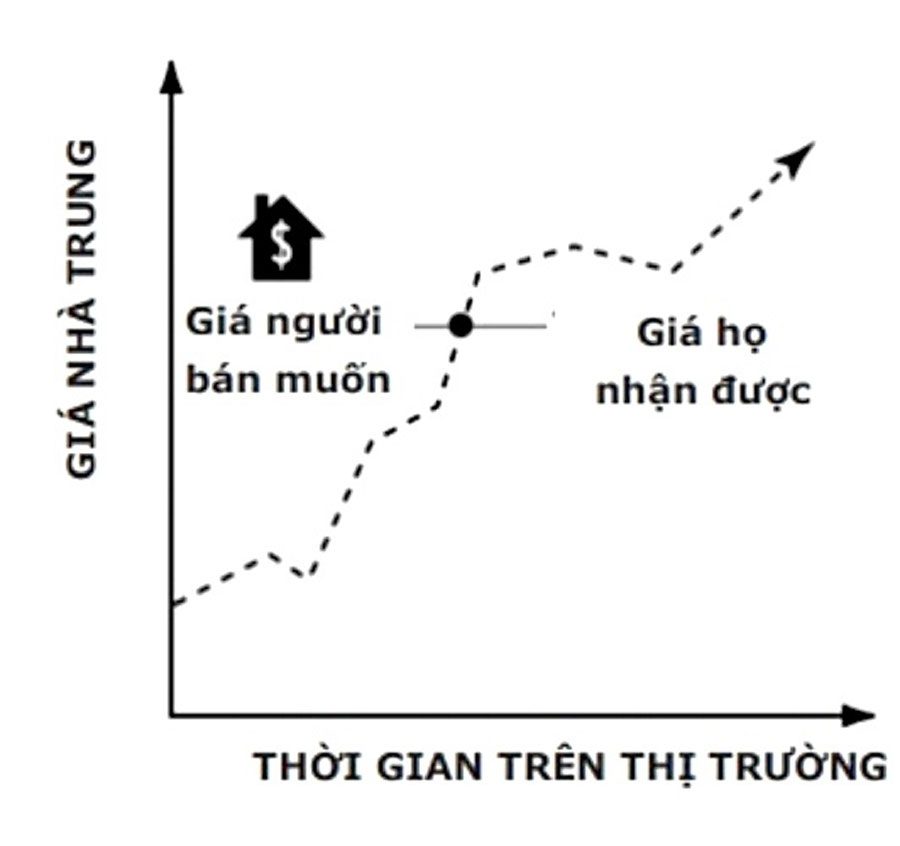

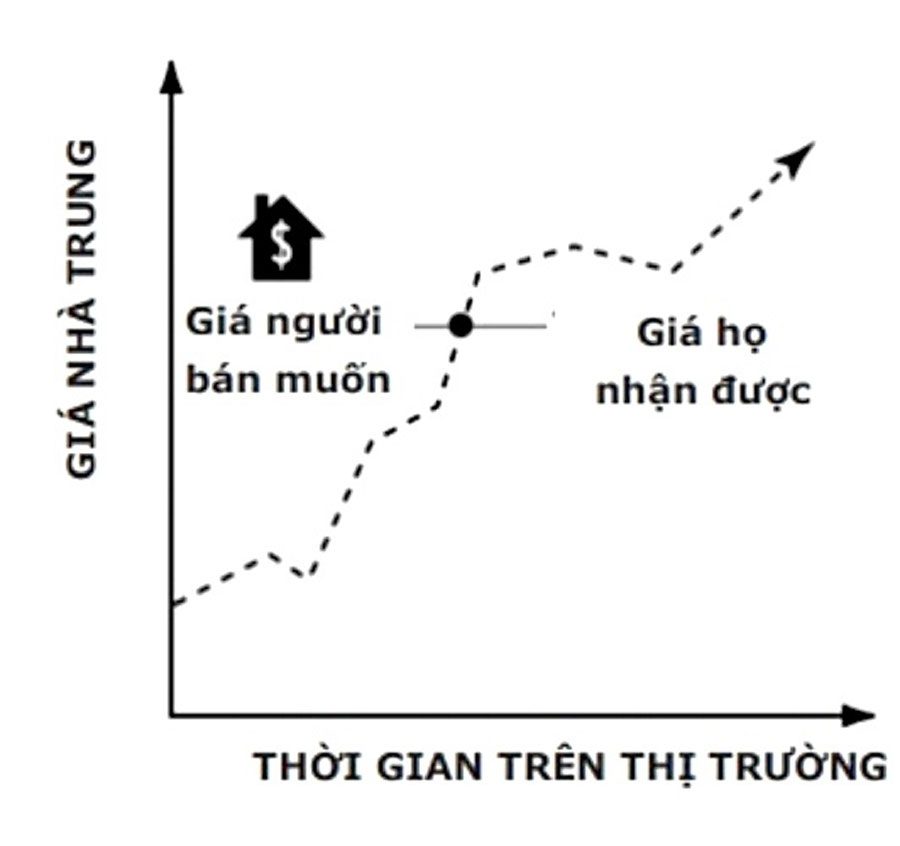

The market’s current ability to grasp the market will change as the market moves upward (upward) or down (depreciated), and even when the market is stable.

When the market tends to go up, sellers can set higher prices and expect market prices to “keep up”, giving them the desired amount given the market’s continued growth. Sellers want to increase prices when the market grows, usually between market prices and selling houses at that time.

When you know the market goes up, sellers can set higher prices and expect market prices to keep up, giving them the desired amount.

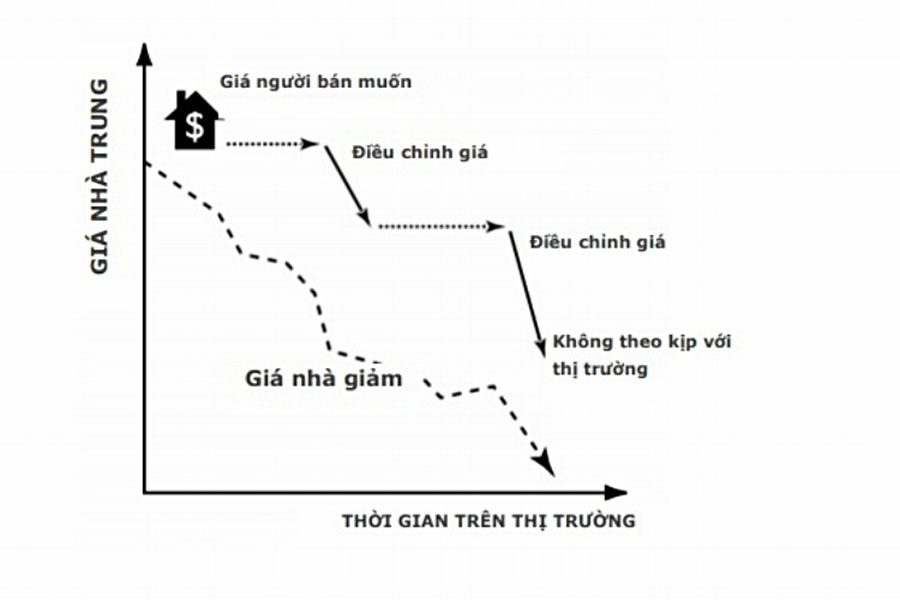

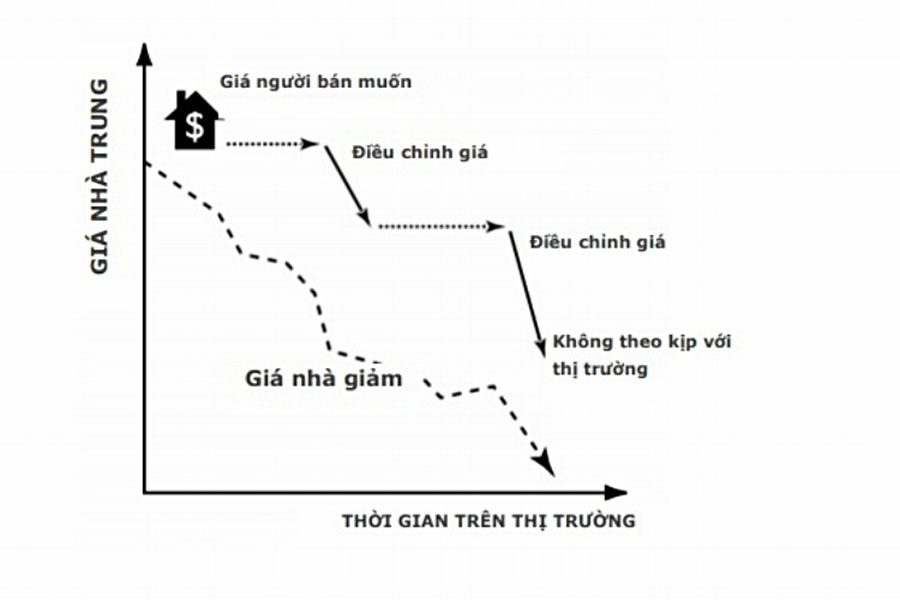

When market prices decline, sellers often make the mistake of overvaluing, hoping to attract desired offers, and think that they will fall in price if the plan does not sell the house.

When the market price drops, sellers often make the mistake of overvaluing and not keeping up with the market.

The fact is that people who do so never discount the market. Therefore, the seller needs to properly price the house to sell instead of “market discount” and take time to sell.

Valuing is a hard job. In Session 5 of the Specialized Investments Intensive Course, experts will advise investors on the appropriate valuation steps with market movements.

In addition to identifying the movement of the market from which the real estate market comes in, investors should be expected to make reasonable decisions with market movements.

In part 2 of Q4, experts will advise investors to expect expectations for their investments, such as offering potential evaluations to projects that want to invest.

You are reading the article Section 4( Part 1): Determining the real estate market in the Real Estate category at https://realestatevietnam.com.vn/. Any information sharing, feedback please contact through Hotline (+84) 898 898 688 (24/7) or email to contact.vietnamrealestate@gmail.com.

Special thanks!