Hotline:

(+84) 898 898 688What are Bank borrowers buy houses scared most ?

According to an annual report from HSBC, rising interest rates are a top concern for people who have home loans around the world.

The report, titled “The Importance of a Home,” published by HSBC, is based on the results of the latest consumer research on homeownership, in which rising interest rates are a concern. The beginning of those who are having home loans around the world.

Borrowers will lose their ability to pay if the bank raises interest rates to 5%

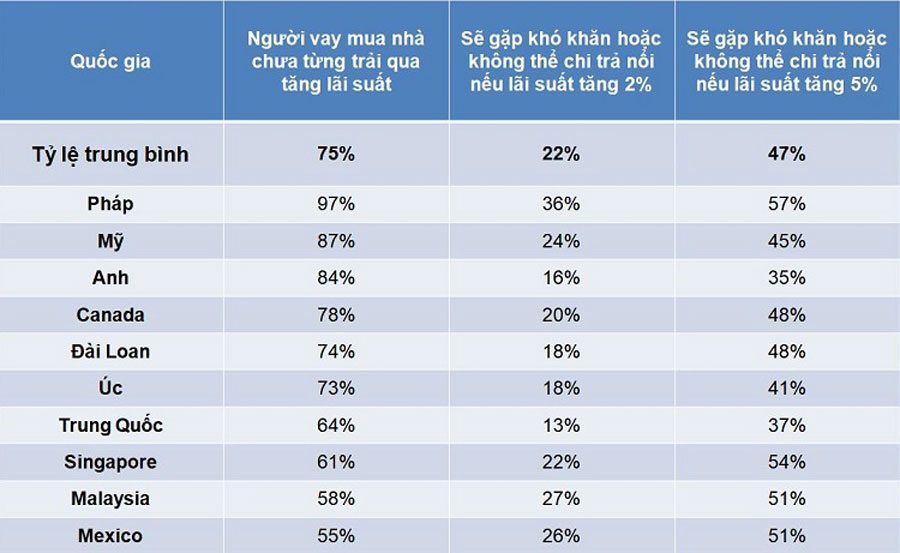

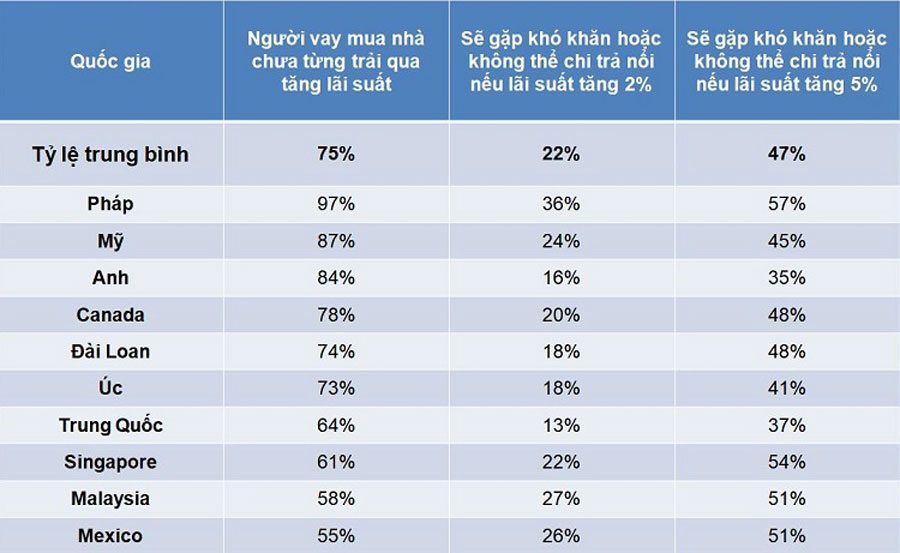

Specifically, the report shows the results of the survey, involving more than 10,000 people in 10 countries (mostly in Europe and Asia), showing that 75% of those who have a home loan have not experienced it. An interest rate increase from the time they start borrowing.

~~>>Update on new information on the real estate news in Vietnam here: Vietnam real estate news

The survey also showed that the impact of significant interest rate increases on homebuyers. Of which: 22% of them said that if the interest rate of the loan increased to 2%, they would have difficulty or unable to pay; The rate is up to 47% if the rate increase is 5%.

In France, up to 36% of people who have a home loan said they would have difficulty if the interest rate of the loan increased by 2%. This is the highest rate in the surveyed countries, compared with only 13% in China. The French will also be the most affected (57%) in the case of a 5% increase in interest rates, compared with 35% in the United Kingdom.

Results of the survey of HSBC

Bank interest rates are also one of the main factors that make borrowers change their lenders. The survey found that 44% of homeowners with mortgage loans changed lenders, while 61% surveyed the market to find a more attractive loan package by changing the loan provider.

55% of survey respondents said that they changed the lender mostly hoping for a better loan package or because of the current increase in interest rates. 24% change lenders as current loans expire and 22% indicate they are moving into new homes or buying new real estate.

In addition, the survey also found that consumers accept a high payment for housing ownership. Those on a mortgage say they spend an average of 38% of their monthly income to pay for a loan.

“Borrowers spend an average of nearly 40% of their monthly income to pay for their home loan,” said Richard Napier, Global Head of Mortgage, HSBC Group. They need to consider the possibility that interest rates will rise on household budgets and should understand the market to get the best interest rates possible. “

The increase in interest rates is a major concern for homebuyers

Increasing interest rates will affect potential homebuyers

According to HSBC, interest rates will also affect potential homebuyers. As 32% of respondents said that the interest rate on home loans increased by 2% will make them difficult or unable to pay. This rate increased to 52% if the rate hike was 5%.

Reserves continue to be a challenge for people looking to buy a home, with 80% saying that saving enough for minimum payments is not an easy task.

Most potential home buyers (69%) plan to make a minimum payment equal to 20% of the value of the home to ensure they are able to access the loan. 78% said they rely heavily on savings to achieve this goal. Those who are having a home loan have spent an average of 5 years saving on minimum payments. French homebuyers spent most of their time on this goal for seven years while British home buyers only took about four years.

>>>See more information about the real estate market here: Vietnam real estate market

Although having a minimum payout is a challenge and increased interest rates will have a significant impact, 41% of those intending to buy a home are willing to do their best to prepare their fiance for a better place.

“Both potential homebuyers and homebuyers are likely to be affected,” said Sabbir Ahmed, Country General Manager of Personal Financial Services and Asset Management, HSBC Vietnam. So banks are responsible for helping clients identify their needs and at the same time advising them on how to make the right decision and able to own a home without having to suffer much pressure.

You are watching the article Borrowers most afraid of what in the Rever Guide. In addition, Rever also sent you a monthly interest rate sheet for a monthly home purchase mortgage through the download link below:

You are reading the article What are Bank borrowers buy houses scared most ? in the Real Estate category

at https://realestatevietnam.com.vn/. Any information sharing, feedback please contact through

Hotline (+84) 898 898 688 (24/7) or email to contact.vietnamrealestate@gmail.com.

Special thanks!