Hotline:

(+84) 898 898 688How to calculate property taxes for an apartment according to the Law on property tax

Ministry of Finance has just released a draft law on property tax law to send comments to relevant agencies. In the draft law, the ministry also introduced the expected annual property tax (withholding tax) for an apartment.

Suppose apartment for living 75sqm in an urban area in Hanoi (20 storey condominium). Apartment purchase price under the purchase contract is VND2.5 billion. The land price in the land price list announced by the provincial People’s Committee for the land plot for construction of the apartment building is VND 10 million / sqm. The investment capital for construction of apartment buildings announced by the Ministry of Construction (according to Decision No. 706 / QD-BXD dated 30 June, 2007) is about VND 9.71 million / m2 (applicable to condominiums from 18 floor to 20 floors).

According to the Draft Law on Property Tax, the calculation of property tax will not be based on the purchase price of the house under the purchase contract is VND2.5 billion but the price of the property tax is determined based on the price of the agency regulatory authority.

Specifically: The taxable price for land is based on the price of 1sqm of land at the Land Price List published by the provincial People’s Committee at the time of tax calculation. The taxable price for a house is based on the taxable house price stipulated by the provincial People’s Committee at the time of tax calculation based on the rate of investment capital announced by the Ministry of Construction.

Total property tax is expected to be paid annually to the house and land by the amount of property tax payable on land plus the amount of property tax payable to the house.

In case of new apartment building

Draft Law on Property Tax Law stipulates that the taxable price for land used for the construction of condominiums shall be determined as equal to the price of 1 sqm of land at the land price table prescribed by the provincial-level People’s Committee. (x) Coefficient for determining the area of land for tax calculation (the law stipulates that the Government assigns the coefficient defining the area of land for tax calculation for land used for the construction of condominiums. Determine the area of land for the intended stay is 0.2%.

Thus, the estimated taxable price for the land identified for the apartment above is:

75sqm x VND 10 million / sqm x 0.2 = VND 150 million

The estimated property tax payable on the land identified for the above apartment (at the estimated 0.4% property tax rate) is:

VND 150 million x 0.4% = VND 600,000 / year

Regarding housing tax, the Draft Law on Property Tax stipulates that the taxable price for new builders is determined by the price of 1m2 of tax calculator set by the provincial People’s Committee (based on the rate of construction investment Announced by Ministry of Construction) (x) the area of the house used by the organization, household or individual.

The property tax calculation date is fixed for 5 years from the effective date of the property tax law

Thus, the taxable price for the house determined for the apartment above is:

75sqm x VND9.71 million/ sqm = VND728.25 million

With the threshold not subject to tax is VND700 million, the apartment above must pay property tax on the house (with the expected property tax rate of 0.4%) is:

VND28.25 million x 0.4% = VND 113,000 per year

Thus, in the case of newly built and non-tax threshold for the house is 700 million, the amount of property tax payable for the land is 600,000 VND; The tax payable for the house is VND 113,000. Total property tax payable for houses and land is VND 713,000 / year.

In case the apartment has been put into use for 7 years

In this case, the amount of property tax expected to be paid for the land is determined as if the new apartment building. Specifically, the expected amount of property tax payable on the land identified for the above apartment (at the expected 0.4% property tax rate) is VND 600,000 / year.

However, the amount of property tax expected to be paid to the detached house for the apartment will be different.

Specifically, Law on Property Tax stipulates that the taxable price for used houses is determined by the price of 1sqm tax calculator set by the provincial People’s Committee (based on the rate of construction investment due to (X) the area of the house used by the organization, household or individual; (x) the percentage of remaining quality of the house.

At present, the provincial People’s Committee is setting the remaining quality of the house to declare and pay registration fee. Therefore, it is expected that the remaining quality ratio of the house for calculating property taxes will be assigned to the provincial People’s Committees (Ministry of Finance will coordinate with the relevant ministries and sectors guide the principle of determining the percentage of substances the rest of the house in the legal documents to the local implementation of unified).

~~>>Update on new information on the real estate news in Vietnam here: Vietnam real estate news

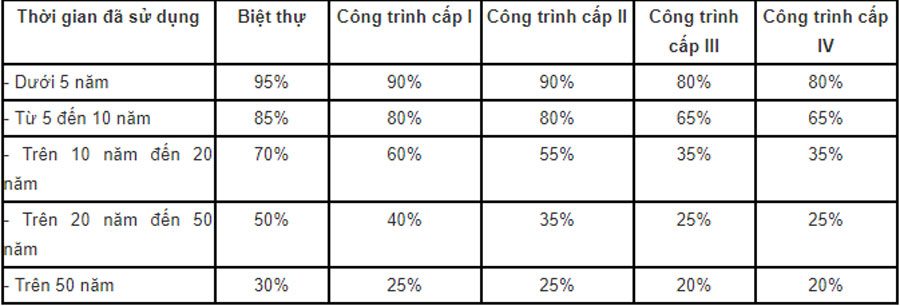

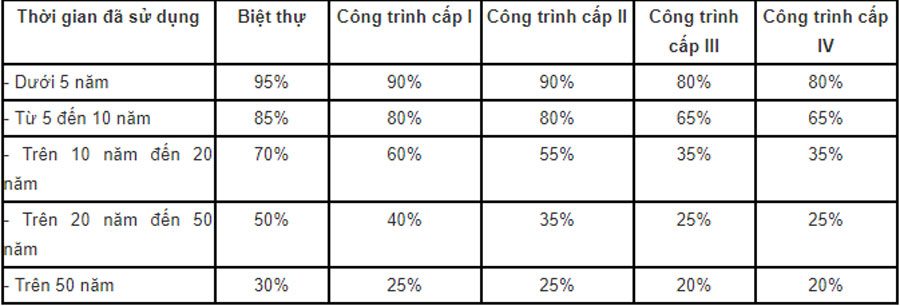

For example, according to the Decision No. 3203 / QĐ-UBND dated 24/5/2017 of the Hanoi People’s Committee, the percentage of residual quality of the house is determined based on the period of using the house. to hand over or put the house into use until the year of registration fee payment declaration:

Assume that the remaining quality ratio of the house for calculating property tax is equal to the remaining quality ratio of the house to declare and pay the registration fee, then the estimated taxable price for the used house The identification for the above apartment will be:

75sqm x VND9.71 million/sqm/ 80% = 582.6 million

Because the estimated taxable price for a used house determined for an apartment is above the non-taxable threshold, therefore, the property tax payable on the home (used over 7 years) applies to the apartment is 0 dong.

Thus, in case the common area has been used for 7 years, only the property tax of VND 600,000 per year will be levied, and no tax will be levied on houses as the value of the house is within the non-taxable threshold.

The property tax calculation date is fixed for 5 years (from the calendar year) from the effective date of the property tax law (ie, in the 5 year stability cycle if there is a change in the taxpayer or a change in the price It is also not necessary to re-determine the amount of tax payable for the remaining period of the cycle.

You are reading the article How to calculate property taxes for an apartment according to the Law on property tax in the Real Estate category at https://realestatevietnam.com.vn/. Any information sharing, feedback please contact through Hotline (+84) 898 898 688 (24/7) or email to contact.vietnamrealestate@gmail.com.

Special thanks!