Hotline:

(+84) 898 898 688Condotel investment is becoming more and more risky

Most of condotel investors do not pay much attention to the development of “tel” (hotel), not planned for operating factors, while the commitment to profit is too high. These are the factors that condotel investment is becoming increasingly risky.

Occupancy and room rates will be under great pressure

According to Savills, tourist demand in Vietnam in 2016 strongly developed in three provinces Da Nang, Nha Trang and Phu Quoc. Specifically, Nha Trang has welcomed nearly 1.2 million international visitors, up nearly 23% compared to 2015. Similarly, international visitors to Da Nang has reached nearly 1.7 million, up 33% over with 2015.

According to Savills, condotel investment is becoming increasingly risky

Development infrastructure (there are 9 international airports in the country), visa policy for tourists improved (the process is easier and the fee is lower than before) is considered factors resulting in the growth of tourist arrivals.

Savills said that these positive signals have boosted the attractiveness and trust of investors in the Nha Trang, Da Nang and Phu Quoc markets, leading to an increase in the supply of condominiums. – Next 3 years.

According to the Savills Hotel Advisory, Nha Trang and Cam Ranh, the supply of midscale luxury hotels and resorts is expected to grow at an average annual rate of 29% over the next three years. according to the.

Similarly, the Da Nang and Phu Quoc markets have strong supply growth of 30% and 27% respectively over the next three years.

However, according to Rudolf Hever, Director of Savills Asia Pacific, the real estate market is volatile and may be affected by many factors.

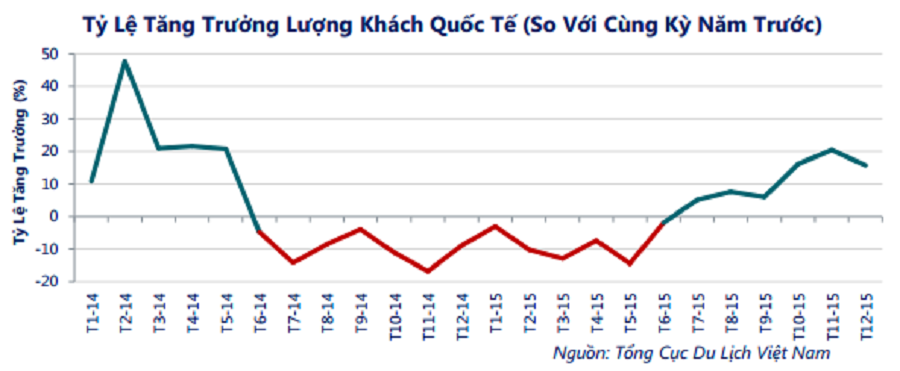

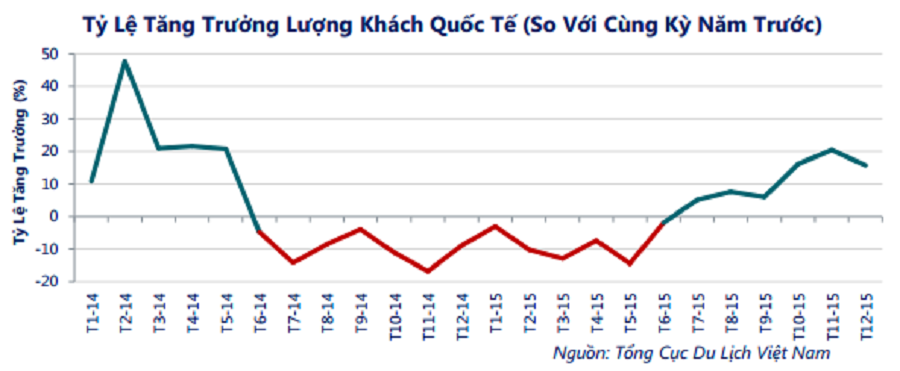

Typically in 2014 – 2015, the number of international tourists to Vietnam fell sharply as the number of Chinese and Russian tourists fell deeply (due to the impact of the dispute over the South China Sea and the devaluation of the ruble). This has had a strong impact on the tourism market, especially for markets that depend mainly on tourists from this market such as Nha Trang.

Tourists – the most important factor for the resort market – are relatively large

“So if demand does not catch up with future supply growth, capacity and room rates are expected to continue to be under pressure and developers will have to weigh performance considerations. Expected and budget for the project in the coming years, “said Rudolf Hever.

Buyers are at risk for condotel

According to Rudolf Hever, in the next three years, a supply of 17,000 houses will be launched in six coastal provinces including Khanh Hoa, Da Nang, Phu Quoc, Ho Tram and Ha Long. & Quang Nam.

In particular, condotel is the type that accounts for the majority. It is estimated that by 2019, the condotel will account for 65% of total supply of “second homes”.

However, the notable point is that the “tel” (hotel) in the condotel model is not yet considered. In most cases, very few operational management factors such as hotels are considered for this component. This is considered to be “particularly worrying” as it is difficult for the developer to guarantee the amount of profit committed.

“In order to generate revenue for the commitment, condotel must be fully operational as a hotel and achieve impressive business results, but most projects are not well planned. “said Rudolf Hever.

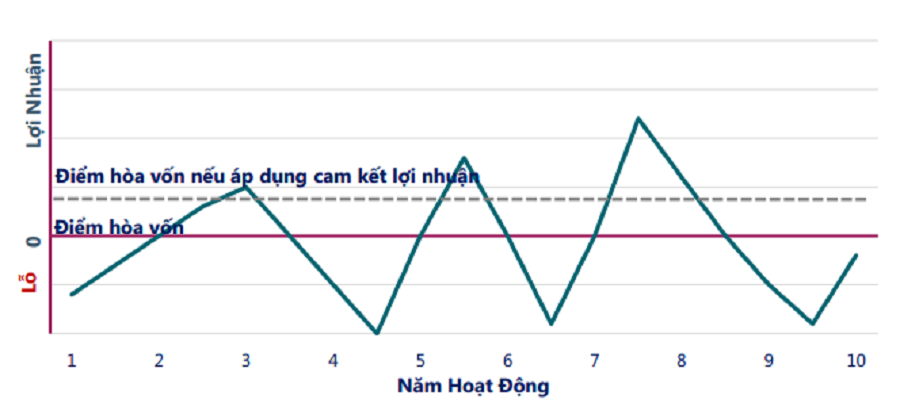

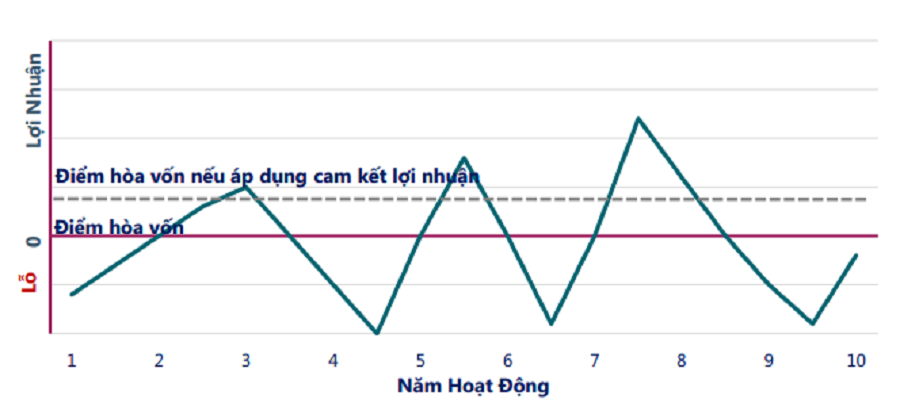

Chart showing profit movements of condotel project owners

The fierce competition in the gold segment is causing investors to increase their product promotions as well as apply a commitment to profit to attract buyers. But the promise of profit brings great risk to customers. The reason is that some developers have little experience but develop large scale projects without a strong budget like equity or bank funding.

These risks mainly come from the operation after completion of the construction and in case the profit margin is higher than the operating cash flow. At the same time, the owner needs to add more capital to secure the commitment. At present, the committed rate of profit in Vietnam is quite high, some projects up to 12% in 8 years.

“Therefore, when selecting real estate products for investment, buyers should consider selecting quality products from reputable investors. , the investor should make good planning as well as conduct feasibility study from the beginning to be able to get a product suitable to market conditions as well as financial ability and ensure good operation in the future “said Rudolf Hever.

You are reading the article Condotel investment is becoming more and more risky in the Real Estate category at https://realestatevietnam.com.vn/. Any information sharing, feedback please contact through Hotline (+84) 898 898 688 (24/7) or email to contact.vietnamrealestate@gmail.com.

Special thanks!