Hotline:

(+84) 898 898 688How to calculate the return on investment for 2018

In this article, Realestatevietnam shows you how to calculate the return on investment for the latest 2018 apartment rental, which you can calculate and apply for your apartment rental.

The formula for calculating the return on investment for rental apartments

If you or your family are planning to invest in a rental property and are wondering about how to calculate profit margins, here are some simple calculations that you can apply:

Rental price per sqm of the apartment in a month multiplied by 12 (months), then divided by sqm value of the apartment will be the percentage rate of rental profit:

For example: A high-grade apartment in District 2 has a price of $ 3.00 / sqm, average rent is about $ 20 / sqm/ month. Total rent received in the year will be $ 240 / m2 ($ 20 / sqm / month x 12 months). So the profit margin in one year will be: (20×12) / 3,000 = 8%.

Above is the calculation of the return on investment for a one-year lease. This formula can be applied to many forms of real estate investment such as apartment, house, land, house … However, besides this number you also have to deduct management fees, taxes, fees maintenance … you also have to estimate the number of months of no rent (vacant) to estimate the specific profit in your year.

Refer to the investment income of rental apartments in the market

In the real estate market today, investment in high-end apartment is taking place by:

- Buyers are more likely to have access to loans, higher loan rates from banks and longer borrowing periods, and reduced payment pressure on loans.

- Demand for luxury apartments is increasing rapidly as multinational corporations have landed in our country more and more. The number of foreigners to work and live in Vietnam is increasing, most of them have demand for rent. Their rents range from $ 1,000 – $ 2,500 per month so it is suitable for high end apartments.

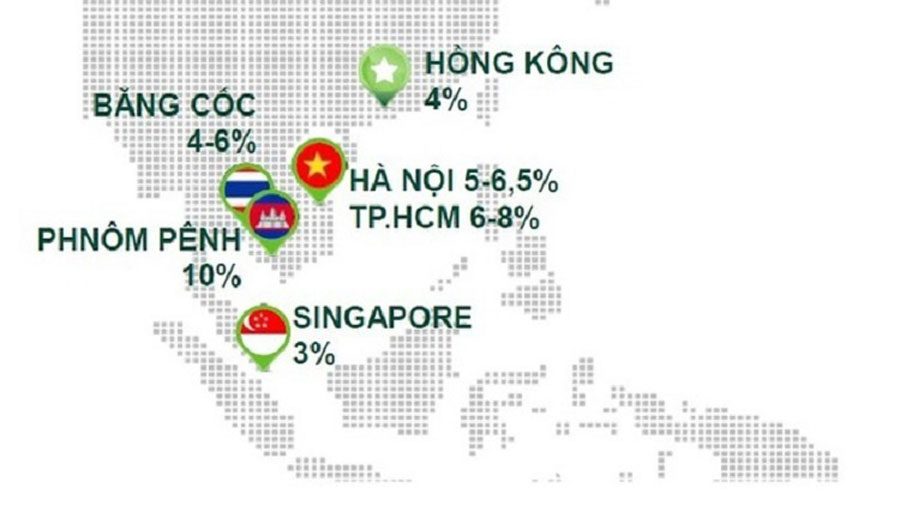

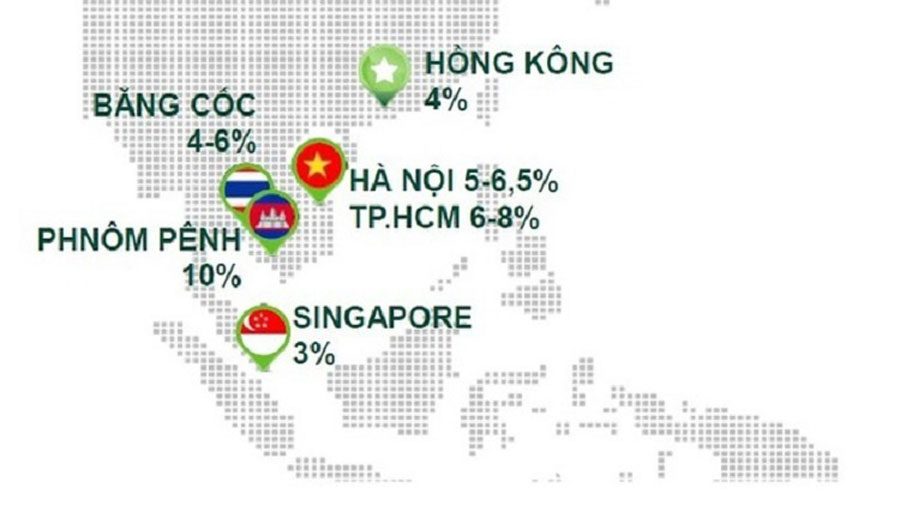

Apartment rental rates in Vietnam are quite high compared to many countries in Southeast Asia

The profit from the rental of luxury apartments today is not small, in other words is very attractive compared to bank savings. Refer to the price and rental price of some real estate projects in two major cities such as Hanoi and Ho Chi Minh City, it is known that the income is calculated in USD in HCMC from about 6% to 8% and in Ha Cabinet is 5% to 6.5%. This rate of return generally includes management fees. Thus, net profit is only about 1% lower than the maximum. With a deposit interest rate of just 5-6% or less than USD savings of only 2%, it is clear that the return on investment in rental apartments is much higher.

However, as Realestatevietnam pointed out above, in order to achieve a good rental rate, rental apartments are required to meet a number of criteria, most importantly the location, quality and management of the unit. project … Customers need to consult these factors carefully before deciding to invest apartments for rent.

Investment experience of rental apartments from reality

Tenants tend to choose apartment projects from reputable investors

- If you intend to invest in a rental property, you should choose large-scale or high-density residential projects. Typically, projects with multiple units will be your rental. the easier. Apartments at the large project will attract customers by the services formed in the building. In addition, the location of the project is located in the neighborhood with the higher population density, the better the ability to rent, with associate or villa should be located in the area with many houses, crowded.

- To increase the efficiency of rental investments, you should choose projects that can receive rental housing immediately, or the investor enough credibility to hand over on time, this is to increase investment efficiency, ensure cash flow Your are flexible.

- You should remember to choose projects with good living environment, accompanied by closed services & high quality: Usually projects with good living environment always ensure the liquidity as well as the rental price is always better because it attractted many customers being interested.

- If the project is in the future or is under construction, then you should choose the projects of reputable investors, big brands and especially the investor widely communicated widely known. .

You are reading the article How to calculate the return on investment for 2018 in the Real Estate category at https://realestatevietnam.com.vn/.Any information sharing, feedback please email to contact.vietnamrealestate@gmail.com, Hotline (+84) 898 898 688 (24/7).

Special thanks!