Hotline:

(+84) 898 898 688Many Countries Also Levy Real Estate Taxes

The real estate tax is an annual revenue source of many countries in the world and helps the market develop healthy and anti-speculation.

On November 1, Ho Chi Minh City Real Estate Association (HoREA) sent a letter to the Ministry of Finance, HCM City Party Committee, HCM City Department of Construction, HCMC Taxation Department who having house 2 or more.

Accordingly, HoREA welcomes the Ministry of Finance is studying to draft a tax on real estate, especially for people from the second home on. “This taxation will help the real estate market to develop healthy, anti-speculation, increase supply to the market, create more opportunities for people with real needs to access housing and increase revenue for a state budget, “said Le Hoang Chau, chairman of HoREA.

Chau said that the tax also directed secondary investors to choose the establishment of real estate business instead of individual business today.

According to HoREA, many countries around the world have taxed real estate. For example, in the United States, property taxes are imposed by states. Each state has different tax rates. In California, the tax rate is more than 1.2% per property value per year. In Texas, the tax rate is more than 4%. The tax rates in the US states vary by the value of the property in the different states.

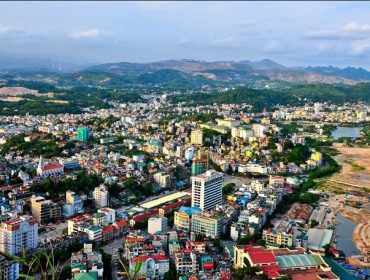

Real estate tax is expected to help the market grow healthy

South Korea applies different tax rates to real estate products such as 0.15% -0.5% for private homes, 0.25% for condominiums, and 4% for villas. , home in the golf course, recreation areas and 5% for homes in large urban areas. The tax rate is calculated on the land price list issued by the local authorities.

Singapore levied a second very high property tax. This tax is called the property tax surplus, which will apply from 2013 on the second property and up to 7% on the purchase price, and 10% on the third property.

In Japan, the property tax rate ranges from 1.4% -2.1% on house and land values at market prices and is adjusted every three years. The UK has just levied property taxes on the second property since April 1-4. For a second property that costs more than £ 40,000, the buyer must pay an additional 3% of the normal rate. Houses cost over £ 1.5m, the tax rate is up to 15%.

In Japan, the property tax rate ranges from 1.4% -2.1% on house and land values at market prices and is adjusted every three years.

“In our country, only land use tax is levied, not taxable housing property. Residential land in urban areas is subject to the tax rate of 0.03% on the land price list for the area of land in the quota. To apply the tax rate of 0.07% for the land area in excess of three times the quota and the tax rate of 0.15% for the land area in excess of three times the quota. In Ho Chi Minh City, the land price is calculated by the land price is only about 30% of the actual market price, so the tax rate is very low compared with the real value, “Chau said.

In taxing a second home or more, HoREA recommends not collecting taxes on social housing, resettlement housing, commercial housing valued at less than VND 1 billion and housing level 4 or below.

At the same time, this tax exemption for households even have a house but are too tight, now buy second, third … but the total area of these small apartments is just under 200 sqm.

“In the initial stage, the tax rate should be reasonable, suitable for the people. For persons having from the second house onwards, the excess property tax rate shall apply, depending on the quantity and value of the property. It is necessary to build and complete the national data and information system. There is a national housing database to know who owns the house, “Chau said.

Previously, the Ministry of Finance has studied taxation of people who have second or more homes. The method of tax calculation is not specified. However, the taxation with the house has been included in the draft Law on house and land tax from 2009.

For persons having from the second house onwards, the excess property tax rate shall apply, depending on the quantity and value of the property.

This bill provides three options for calculating home taxes. After consultation with the Financial Commission, the Budget proposes to choose a tax option for the second homeowner and applies a tax rate of 0.03%

The Standing Committee of Finance of the Budget said that this is the approach to receive opinions of many National Assembly members, basically will create a consensus among the people. Ensure that every citizen has a non-taxable house with a low tax rate of 0.03% so that it will not affect the psychology and economic life of the people.

Looking forward, the Ministry of Finance will come up with a plan, specific tax rates … also depends on the economic situation, comments.

You are reading the article Many Countries Also Levy Real Estate Taxes in the Real Estate category at https://realestatevietnam.com.vn/. Any information sharing, feedback please contact through Hotline (+84) 898 898 688 (24/7) or email to contact.vietnamrealestate@gmail.com.

Special thanks!