Hotline:

(+84) 898 898 688Why foreign luxury pours luxury real estate in Saigon?

The gold location projects in HCMC are “soft” compared to regional, lower tax rates, good rental and more opportunities for price increases.

Savills International has announced a report on real estate for the rich and super rich in HCMC, attracting many foreigners. The projects located on Saigon gold land are in the view of international investors in a stronger way than ever.

International investors are likely to look at opportunities to enter emerging markets such as Ho Chi Minh City, as the value added is remarkable when compared to their home countries. they. In fact, investors (individuals) from Korea, Hong Kong, Taiwan, China … after a period of careful exploration, finally decided to participate in the real estate market HCMC.

The evidence for this excitement is that the foreign guests always occupy the room for foreign investors in the project of good location, quality standards from reputable investors. Savills offers four reasons why luxury real estate in HCM City attracts foreign investors in recent years.

Real estate is located in Ho Chi Minh City

Competitive price

Since the law allows for foreign ownership, foreigners are more likely to focus their capital on Vietnam, in order to take advantage of relatively competitive prices when comparing Vietnam and other countries remaining in Asia.

New home prices in downtown HCMC average $ 5,500 to $ 6,500 per square meter, representing 25 percent of the average value of real estate in Taiwan and a quarter in Hong Kong, where prices are always high. at all times. In Singapore, penthouse apartments in the central area cost up to tens of millions of dollars.

Compared with other countries and territories in the region, luxury apartment prices in HCM City are still extremely competitive if they are not called “soft” for foreign investors to consider.

Taxes are lower than other countries

There are things to keep in mind. For example, in Taiwan, property owners are subject to additional taxes and fees, while buyers in Vietnam only pay 10% VAT and payment. once a 2% maintenance fee. In addition to these advantages, the demand for real estate investment in Vietnam has increased significantly since 2015 when housing law was opened to international investors because prices are more attractive than what they can buy in the home market.

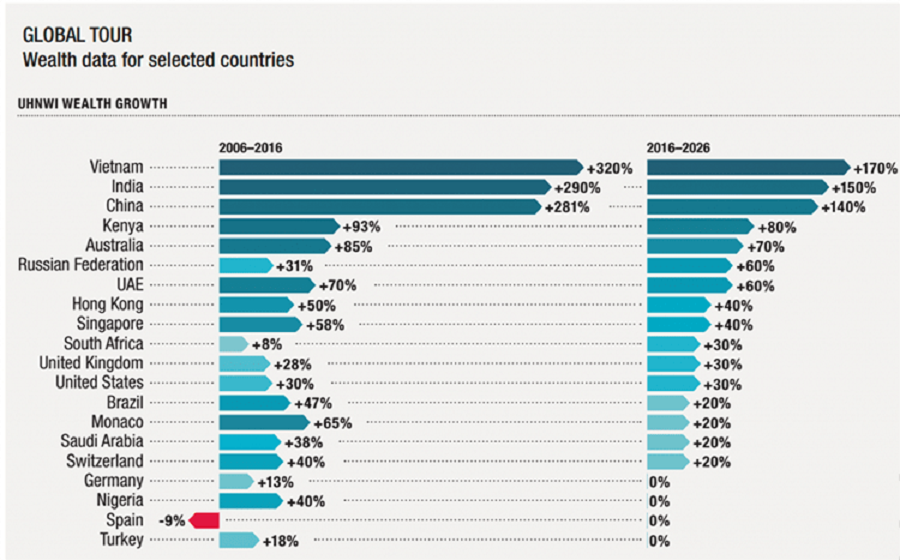

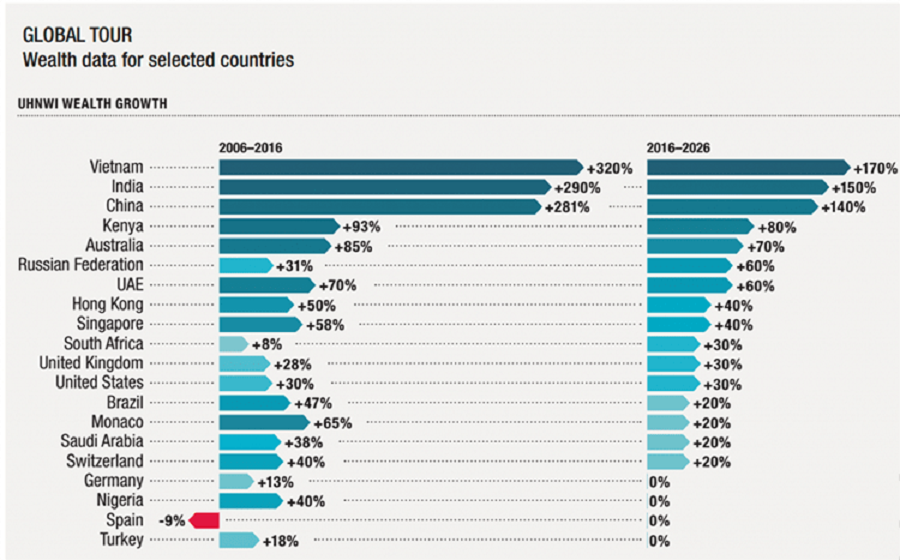

Individuals with extremely high net worth in Vietnam increased by 320% between 2006 and 2016

Potential of price increase of luxury segment

Although Vietnam is still a developing country, only the emerging markets, the HNWIs (individuals with high net worth) have increased significantly in the last 10 years. Accordingly, with the new supply of high-grade buildings limited to the entire city, the price and value of the property are always high with ideal absorption.

According to The Wealth Report published by real estate consultant Knight Frank, the ultra-high net worth individuals (UHNWI) in Vietnam have grown by 320% – the highest rate in the world 2006 – 2016, followed by India and China. This figure is expected to increase by about 170% from 2016 to 2020 and at the same time is the fastest growth rate in the world at this stage.

With the most exciting urban areas in the country, luxury real estate in Ho Chi Minh City has a high growth trend, long-term investment opportunities, promising potential for price increases and opportunities to break through strongly.

Rental rate is high

This unit said the profitability of the luxury real estate segment in HCMC is extremely attractive. In District 1, 3, there are many high-end projects with a profit rate of around 4%. However, if you move to District 2, Thao Dien, An Phu and especially Thu Thiem, which will be the new center of this city in the future, the high-end apartment here is profitable rate reaching 5 – 6.5%.

At the same time, ROI of ASEAN luxury condominium investment ranges between 3.7 and 5.2 per cent, and in Asia is at the same level. Therefore, the profitability of luxury real estate in HCMC is considered quite competitive at equal levels to higher than the region while the price is cheaper.

You are reading the article Why foreign luxury pours luxury real estate in Saigon? in the Real Estate category at https://realestatevietnam.com.vn/. Any information sharing, feedback please contact through Hotline (+84) 898 898 688 (24/7) or email to contact.vietnamrealestate@gmail.com.

Special thanks!