Hotline:

(+84) 898 898 688Effective Investment With 8 Principles

Real estate is a valuable asset, investing in real estate is considered a highly profitable trading channel. But, how to make a profitable investment and reduce risk?

Vietnam Real Estate would like to introduce 8 golden principles shared by leading experts:

Principle 1: Pay attention to the location

The prime factor shaping the value of real estate. It can be said that location is an important factor that greatly affects the future development of the project. The higher the profitability of a property position, the greater the value of the property. Projects located in urban centers or certain key economic zones will be of greater value than similar real estate properties located in the CBD.

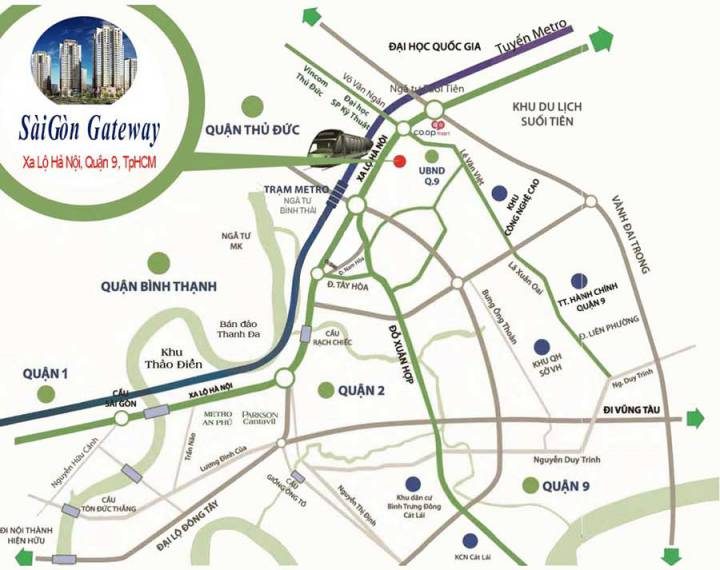

Saigon Gateway apartment has the frontage of Hanoi Highway, District 9. This is considered to be extremely favorable location, linked to the Ben Thanh – Suoi Tien metro line 1 is gradually into operation phase.

Projects located on important arteries or intersections are also of higher value than those located elsewhere. It is extremely important to consider evaluating the positional advantage of a property, especially when evaluating the price.

Principle 2: Time to survey the project

When deciding on a project to invest in, the buyer should choose an effective project investigation time. Many people are used to seeing the project during the day. However, at that time, local residents often went to work. The most appropriate time to survey the project is in the evening, at night from 20h to 21h, when the building and the residential area light up, as it is time for all activities and activities of the residents are reflected. The clearest. So, take the time to visit the project at the right time.

>>> Read more: Invest In Saigon Gateway Apartment Should Or Should Not?

Principle 3: Pay attention to real estate prices

The problem of borrowing for investment needs to be scrutinized. Choose the right property for your financial ability. Use financial leverage – that is, borrow more money to invest. However, you should only borrow less than 50% of the value of the property to avoid future interest rate burdens or higher risk leading to the sale of real estate losses.

Principle 4: High liquidity of the project

Whether you are planning to invest in real estate in the downtown or suburbs, the key to high profitability is the liquidity of the project. Liquidity is simply understood as the ability to convert into cash. Try asking a few questions to assess the “liquidity of the project”: “As soon as you buy the project, do you resell the buyer?” Even need money, now sell a little cheaper, have people buy it or not? “One or a few years from now, who will buy it and how much can it sell?”

Principle 5: Clear legal project

Buy real estate projects of reputable investors will always bring the products are guaranteed the quality, progress of complete infrastructure as well as legal transparency. Investing in a legally clear project will help buyers avoid future trading risks and increase liquidity for real estate. At present, developers aim to publish legal and bank guarantees for each project, to solve the problem of creating trust for customers.

Principle 6: Synchronized Transport and Infrastructure

Infrastructure, facilities and transportation network are one of the factors to consider in the future if you want high real estate. In the future, what is the regional network and neighboring areas flourishing? Projects that are located at key junctions, easy linkage will bring tremendous value to regional infrastructure, helping real estate projects rise to new heights.

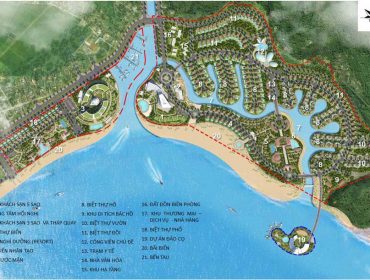

>>> Read more: Experience Of Investment In Vipearl Villa Phu Quoc

Principle 7: Geodetic factors

Unlike buying a home to settle – investing in real estate requires the owner to know carefully that the purchase price of land for investment must be higher than the construction price. In areas where the value of land is higher than the cost of construction, in the future, the area will have high urbanization rate. On the contrary, projects with higher construction prices, the process of urbanization is slow. , Invest less profit.

Principle 8: Surrounding Communities

The living space and surrounding communities have a great impact on the quality of life and investment possibilities in the future, especially rental investment. Two questions that need to be addressed are: “Who are your neighbors if you buy this project and the community here is civilized?” This will make a great contribution to determining whether your project really attracts business.

You are reading the article Effective Investment With 8 Principles in the Real Estate category at https://realestatevietnam.com.vn/. Any information sharing, feedback please email to contact.vietnamrealestate@gmail.com, Hotline (+84) 898 898 688 (24/7).

Special thanks!