Hotline:

(+84) 898 898 688The Price And Rental Margin At The Park Residence Is Better Than The Adjacent Projects?

In 2017, The Park Residence is one of Phu Hoang Anh’s handy projects to be handed over in Saigon South. According to experts in the industry, the selling price and rental margin at The Park Residence are better than nearby projects, which provides good investment opportunities for investors.

Where is The Park Residence in HCMC apartment rental market?

The rental market segment is considered as a potential investment channel and less risky than other forms of investment. However, from the second quarter of 2017, the status quo tend to increase as more and more projects mushroom. Especially the Metro subway projects because of good investment potential. Choosing rent projects in potential development areas, evaluating selling prices and comparing rental yields with neighboring projects is a strategic investment option for keen investors.

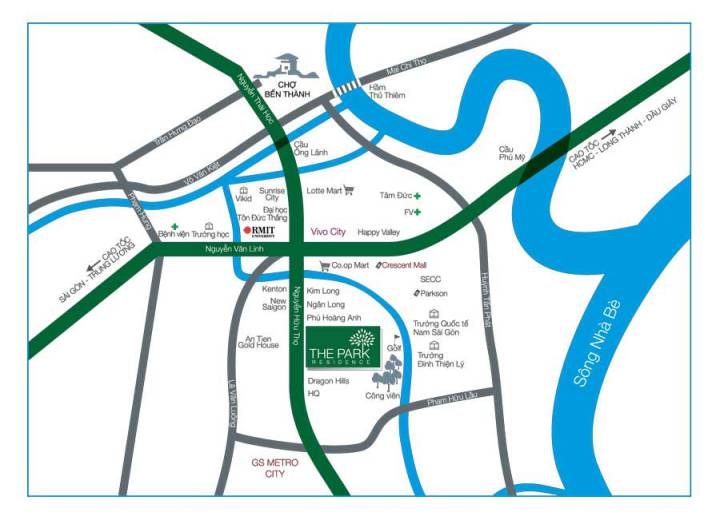

The Park Residence is located in the backbone road of Saigon South which connects to neighboring areas through many traffic planning projects such as tunnels and bridges at the Nguyen Van Linh – Nguyen Huu Tho intersection. , The project to expand Nguyen Huu Tho, Kenh Te 2 Bridge and Nguyen Khoai Bridge connecting District 7 and District 4, … In the future, this area will become the development speed which brings a new face to the area as well as “warm up” the real estate market.

You can read more: Should You Rent The Park Residence?

The prime location of The Park Residence

Nguyen Huu Tho street is 62m in width and will be upgraded to 6 lanes with the parallel Metro No. 4 running in parallel which meet the demand of large traffic in the future. It will boost the demand for rental in this area. The Park Residence along with Dragon City, Phu Hoang Anh, Hung Phat Silver Star, … will be an ideal hiring place for many tourists and residents to live in Saigon South.

Price and rental rates of The Park Residence

Up to now, the selling price and rental rate of The Park Residence are quite good on Nguyen Huu Tho Street. Handled over from the second quarter of 2017, the price of The Park Residence ranges from 26-28 million / m2 which is cheaper than nearby projects from 15-20%. At the opening of the first phase, selling price is 21 million / m2. With an area of 52-106m2, the price of apartment here is only 6-12 million / month, the average annual profit rate is 7.1% / year. Meanwhile, the Dragon Hill project is 6% per year, Hung Phat Silver Star is about 6.8% per year.

| Rate of return between neighboring projects | ||

| Project | Estimated rent price (VND/month) | Rate of return (%/year) |

| Dragon hill | VND 12 million | 6% |

| Hung Phat sliver Star | VND 12 million | 6.8% |

| The Park Residence | VND 10 million | 7.1% |

Unlike other luxury apartments in District 7 and Saigon South. The Park Residence is the only small apartment project in Saigon South with modern and sophisticated Western-style architecture. The Park Residence is an apartment that meets the income of the majority of the people but still ensures the quality and living space close to nature.

Advantages of renting The Park Residence:

- Great location, move to District 1 center quickly

- Full facilities (5,000 sqm, yoga, gym, club house …)

- Flexible space, comfortable living space

- Complete basic furniture transfer, can move in immediately

- The surrounding area is the existing residential area, adjacent to the adjacent area

- Attractive rent, high profitability

- Management fee is only VND 7,000-9,500 / sqm / month

- Be assisted in transfer management and subleasing of the apartment upon request

The note when investing for rent at The Park Residence

The Park Residence is the only small apartment project in Saigon South with modern and sophisticated Western-style architecture.

>>> Read more: Updating On The Latest Progress And Feeling About The Park Residence Project

Rental prices of high-end apartments in Ho Chi Minh City are achieving attractive returns of about 7.5 to 8% per year, but this rate may decline in the next few years when supply is high. And the number of tenants has not changed much. Deciding to invest in The Park Residence, you should note the following issues:

The first, real estate for rent is only for investors who have a business sense and know about business.

The second, when buying real estate for business, you have to look at future value. You should use the discounted cash flow method to see if the investment is effective.

The third, considering the location factor and potential development of the project in the area

The fourth, you should use financial leverage, or use your money to buy but must turn around quickly

The fifth, calculating the profitability rate is how much. Comparing sales prices and margins against neighboring projects. In the next few years, how does profitability change? Is it feasible?

You are reading the article The Price And Rental Margin At The Park Residence Are Better Than The Adjacent Projects? in the Real Estate category at realestatevietnam.com.vn/. Any information sharing, feedback please contact through Hotline (+84) 898 898 688 (24/7) or email to info@realestatevietnam.com.vn.

Special thanks!